La temporada de compras incorrecta puede arruinar todo su plan de suministro: 2025 no es el año para equivocarse.

Q2 de 2025 es el momento ideal para comprar FMCG 1 debido a las tarifas de flete estables 2 , los tiempos de entrega más rápidos 3 y menos incertidumbres del mercado.

Solía ser seguro para comprar durante el tradicional boom del tercer trimestre, pero ya no. Con la inestabilidad global de la política comercial, el aumento de los costos de flete y los horarios de envío impredecibles, esperar podría costar más de lo que piensa. Desglosemos lo que ha cambiado y por qué actuar a principios de año podría hacer o romper sus márgenes.

¿Por qué Q2 se ha convertido en la nueva ventana de compra máxima?

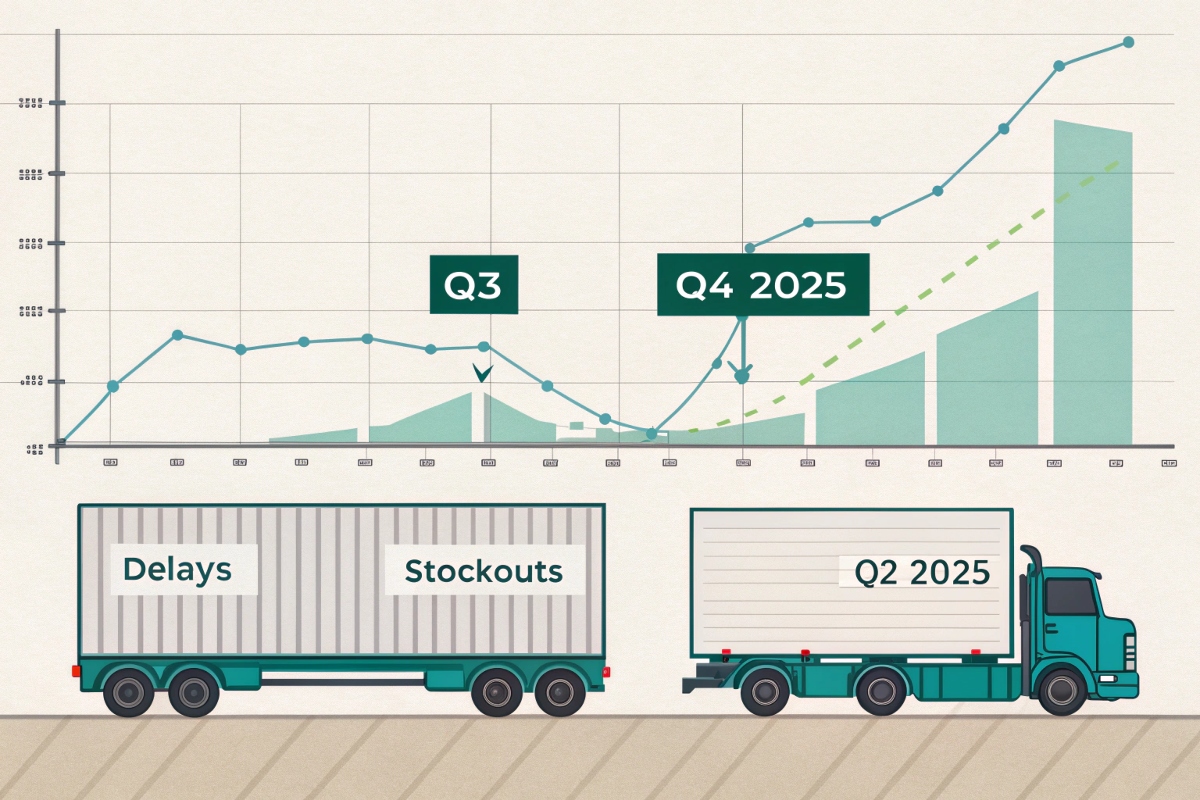

Esperar el Q3 puede ser un error costoso ya que los costos de carga y el envío de plazos de plomo 4 se descontrolan.

Los precios de la carga Spike 5 , los retrasos se acumulan y los desacuerdo se vuelven más frecuentes en el tercer trimestre y el cuarto trimestre. Q2 ofrece una mejor estabilidad y ahorro de costos 6 .

Las tarifas de flete están subiendo más rápido que la demanda

Veamos los datos. De enero a marzo de 2025, las tarifas de envío de Asia a América del Norte 7 aumentaron en un 22% en comparación con el cuarto trimestre de 2024. Los transportistas están reduciendo las navegaciones para controlar la capacidad. Esto está empujando a más compradores al segundo trimestre para bloquear mejores contratos de flete 8 antes de que llegue la congestión del tercer trimestre.

| Cuarto | Avg. Tasa de contenedor (USD) | Tiempo de entrega (días) |

|---|---|---|

| Q1 2024 | $2,200 | 28 |

| P4 2024 | $3,050 | 42 |

| Q1 2025 | $3,500 | 35 |

La tabla muestra cómo esperar demasiado puede afectar tanto su costo como su capacidad para entregar el tiempo. Cuando pedí toallitas de limpieza a granel para un distribuidor norteamericano en el tercer trimestre del año pasado, se perdieron su campaña de regreso a la escuela por completo debido a la congestión de aduanas 9 y la reinversión del contenedor. Lección aprendida.

La incertidumbre del mercado favorece los primeros mudanzas

Con las continuas tensiones sobre los aranceles estadounidenses sobre los productos chinos, muchos compradores de FMCG 10 dudan. Esa vacilación a menudo se vuelve inacción, y es cuando las oportunidades desaparecen. La mayoría de los clientes con los que hablo están preocupados por los cambios repentinos de la política comercial o los aranceles adicionales en el puerto.

Pero los que se mudaron en el segundo trimestre de 2024 pasaron por alto lo peor. Aseguraron suficiente stock a precios razonables y evitaban el drama aduanero 11 . Ese mismo patrón está surgiendo ahora.

¿Cómo el riesgo de inventario 12 en la estrategia 2025?

No reponer el inventario temprano significa recursos iniciales, ventas perdidas y espacio perdido.

Los distribuidores son más cautelosos, pero también más agresivos con el reabastecimiento una vez que la ventana se ve clara. Q2 es esa ventana en 2025.

La demanda es estable, pero los ciclos de inventario son más cortos

Un cambio importante que he notado es que los clientes B2B ya no tienen existencias durante largos períodos. Prefieren el inventario más delgado 13 , lo que significa un reposición más frecuente. Este ciclo ejerce presión sobre el tiempo de adquisición.

Visualizemos cómo se ve:

| Mes | Estado de inventario del comprador | Comportamiento de compra |

|---|---|---|

| Jan - Feb | Exagerado | Espera y mira |

| Mar -abril | Stock bajo visible | La reposición comienza |

| Mayo -mun | Compra agresiva | Pedidos de gran volumen |

| Jul -sep | Alta flete + retrasos | Plazos perdidos |

| OCT - DEC | Revolcarse o agotarse | Oportunidad perdida |

La conclusión clave? Esperar la ola tradicional Q3 ahora conduce al caos. La planificación para el segundo trimestre significa una adquisición más suave y una entrega más rápida.

Fatiga de adquisiciones y parálisis de planificación

Después de años de interrupciones covid, muchos equipos de adquisición se queman por constantes extintos de incendios de la cadena de suministro. Esto está impulsando una preferencia por la compra temprana estable. A menudo escucho: "Cerremos esto antes de que comience la locura". Ese cambio de mentalidad está impulsando la tendencia Q2 en 2025.

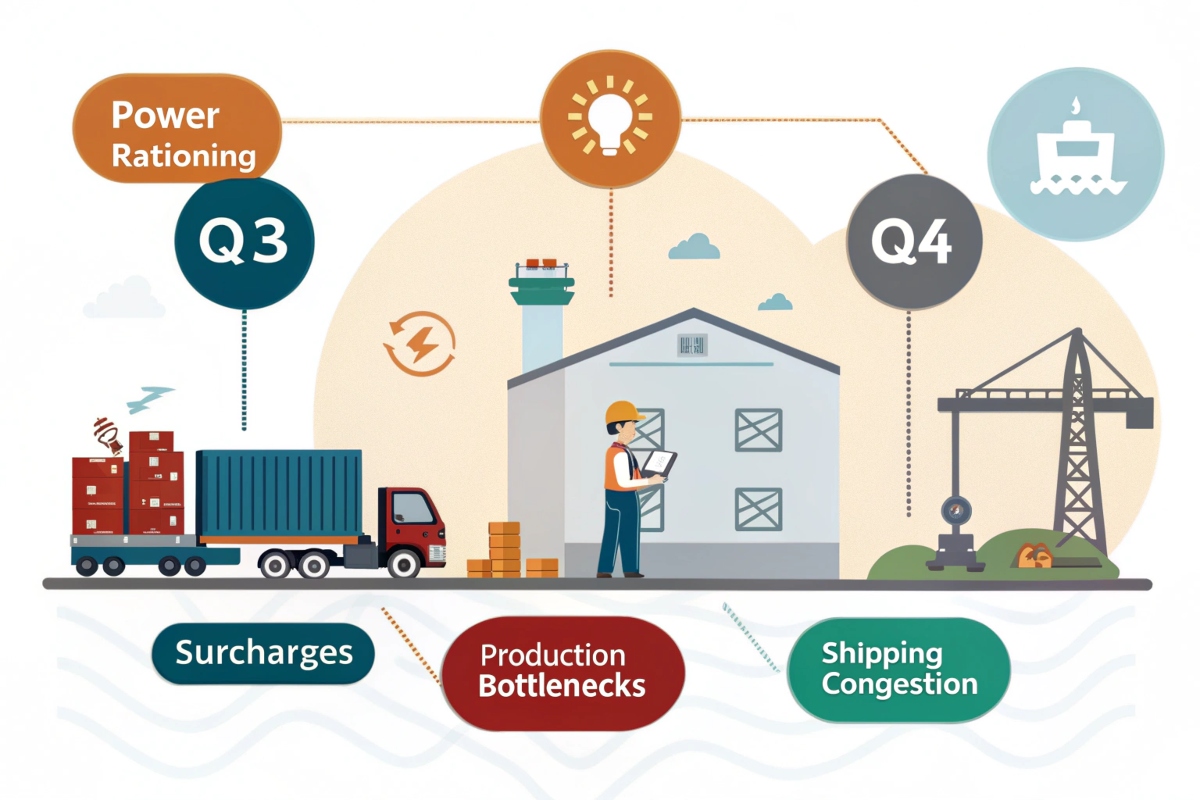

¿Qué riesgos están aumentando en el tercer trimestre y el cuarto trimestre?

Q3 no es solo más caro, es impredecible, ineficiente y puede descarrilar sus operaciones.

Espere recargos, cuellos de botella de producción 14 , congestión de envío e incluso racionamiento de energía en algunos centros de fabricación.

Retrasos de compuestos de costos de flete y energía

En 2024, vimos el racionamiento de energía 15 en varias provincias chinas durante los meses máximos de producción. Si ese patrón regresa, los compradores del tercer trimestre pueden encontrarse en la parte posterior de la línea.

Además, los principales reenviadores ya han emitido advertencias sobre la escasez de capacidad esperada a partir de julio de 2025. Agregue a esa escasez de contenedores, especialmente para compradores menos que contenedores (LCL), y usted tiene una receta de retraso y decepción.

Así es como se suma:

| Tipo de riesgo | Impacto de Q2 | Impacto Q3/Q4 |

|---|---|---|

| Tarifas de flete | Bajo | Alto |

| Tiempo de entrega | Moderado | Largo/poco confiable |

| Capacidad de fábrica | Disponible | Totalmente reservado |

| Despacho de aduana | Rápido | Congestionado |

| Riesgo arancelario | Manejable | Incierto |

Cuanto más espere, más variables se acumulan. Por eso, los compradores con mejor rendimiento están cerrando sus planes del segundo trimestre ahora, especialmente para consumibles de alta rotación como toallitas, toallas y paños de limpieza.

¿Qué tipos de beneficio de FMCG más de la adquisición de Q2?

Los productos con vida útil corta, rotación constante o alta demanda estacional deben moverse temprano.

Las toallitas para la limpieza del hogar, los kits de atención automotriz y los artículos de cuidado personal Vea la mayor ventaja de adquisiciones cuando se asegura en el segundo trimestre.

Los vendedores rápidos requieren una planificación más rápida

En Elbert, la mayoría de nuestros clientes ordenan de 2 a 4 meses antes de su 16 promocional . Por ejemplo, los socios europeos reabastecen las toallitas y las toallas de microfibra para mayo para una campaña de verano. Si esperan hasta julio, los productos llegan tarde o al doble del costo de flete.

Así es como la planificación busca diferentes categorías de FMCG 17 :

| Tipo de producto | Mes de pedido ideal | Pico del mercado objetivo |

|---|---|---|

| Limpieza de toallitas | Abril -mayo | Julio -agosto |

| Toallas de cocina | Marzo -abril | Q3 Ola promocional |

| Toallitas para bebé | Puede | Demanda siempre |

| Telas para el cuidado de automóviles | Abril | Temporada de autos de verano |

Si su producto necesita llegar a los estantes antes de septiembre, Q2 es su mejor oportunidad para hacerlo bien.

Conclusión

Q2 2025 ofrece el mejor equilibrio de costo de carga, disponibilidad de producción y plazos de entrega para compradores de bienes de consumo.

Elbert Zhao

, Elbert Wipes Solutions

📧 [Correo electrónico protegido] | 🌐 www.elbertwipes.com

8 líneas de producción | 22 líneas de procesamiento | OEKO-TEX Certificado | Proveedor aprobado por Walmart

-

Explore este enlace para comprender las estrategias de compra efectivas para FMCG, asegurando que tome decisiones informadas en 2025. ↩

-

Aprenda cómo las tarifas de flete estables pueden mejorar la eficiencia de su cadena de suministro y la gestión de costos. ↩

-

Descubra las ventajas de los tiempos de entrega más rápidos y cómo pueden mejorar el rendimiento general de su cadena de suministro. ↩

-

Explorar el impacto del envío de los plazos de entrega puede ayudarlo a optimizar su cadena de suministro y evitar retrasos costosos. ↩

-

Comprender los factores detrás de los picos de precios de flete puede ayudarlo a tomar decisiones de compra informadas y ahorrar costos. ↩

-

Aprender sobre las estrategias de ahorro de costos puede mejorar su estrategia de compra y mejorar sus márgenes de beneficio. ↩

-

Comprender las tarifas de envío actuales puede ayudarlo a tomar decisiones informadas para su logística y presupuesto. ↩

-

Explorar estrategias para asegurar mejores contratos de carga puede ahorrarle dinero y garantizar entregas oportunas. ↩

-

Aprender sobre la congestión de aduanas puede ayudarlo a evitar demoras y mejorar la eficiencia de su cadena de suministro. ↩

-

Conozca los desafíos que enfrentan los compradores de FMCG, especialmente en los mercados inciertos, para navegar mejor sus propias estrategias de compra. ↩

-

Evitar el drama aduanero es esencial para operaciones suaves. Este recurso lo ayudará a comprender cómo navegar por la aduana de manera efectiva. ↩

-

Comprender el riesgo de inventario es crucial para que las empresas optimicen su cadena de suministro y eviten los recursos incumplimientos. Explore este enlace para obtener información en profundidad. ↩

-

Explorar este recurso proporcionará información sobre cómo el inventario más delgado puede mejorar la eficiencia y reducir los costos en las operaciones B2B. ↩

-

Comprender las causas de los cuellos de botella de producción puede ayudarlo a mitigar los riesgos y mejorar la eficiencia de su cadena de suministro. ↩

-

Comprender el racionamiento de energía puede ayudarlo a anticipar las interrupciones de la cadena de suministro y planificar en consecuencia. ↩

-

Aprenda estrategias para planificar temporadas promocionales para maximizar las ventas y minimizar los costos, asegurando la disponibilidad oportuna del producto. ↩

-

Comprender las categorías de FMCG puede ayudarlo a optimizar su planificación e gestión de inventario para obtener mejores resultados de ventas. ↩